Prediction markets: “the next big long-tail high-variance metagame onchain”

GC ALPHA 63

Disclaimer: None of this information should be taken as financial advice. DYOR + I will hold some of the assets mentioned in this newsletter.

PRODUCT REVIEW:

No review for this week.

Next week, we will explore… (shill me a cool app)

MARKET TALK

PREDICTION MARKETS: THE NEXT META?

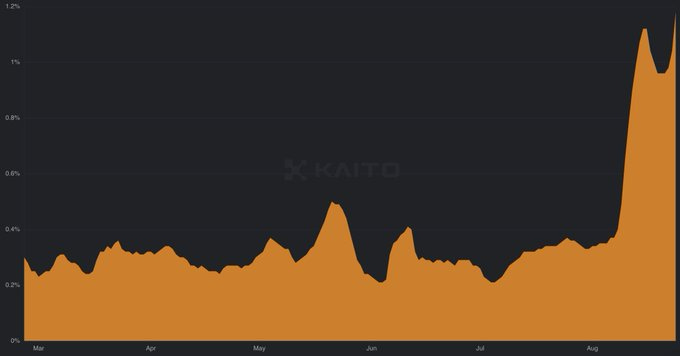

Recently, CT has started pushing prediction markets (PMs) again. The mindshare for it rose by 4x in August alone. Are prediction markets here to stay for the long term, or are they just another fad in crypto?

PMs are platforms that facilitate the ability to predict (speculate on) a certain outcome, e.g., sports games, decisions by the FED, BTC price action, etc. In a way, they can financialize everything that can be tangibly measured

Last year, Polymarket caught a lot of traction during the Presidential elections

Polymarket is a platform that suits all kinds of predictions, but more niche-specific platforms can cater to specific user bases/categories

Sports is one of the largest verticals within PMs, as sportsbooks are already an enormous and proven industry

Football is a subniche of sports PMs, and you could argue the app that’s glued to your timeline, Football.Fun is one. An app revolving around predicting match and player outcomes

John Wang, the loudest voice on CT of prediction markets, argues that “prediction markets are just options in disguise, except 10x more legible for retail and simpler to trade”. Essentially, a Trojan Horse for options

He also mentions how PMs make speculation more accessible, explainable, relevant, social, and more by taking the example of the prediction of Taylor Swift returning with an original album this year

Gaming is another subniche within PMs, a category we’ve seen general platforms such as Kalshi lean into, but also specialized platforms like Soulbound TV (RIP), FORKAST, and more recently, Thousands Network (TN)

TN introduced its Meta Oracle recently, a “micro-outcome-forecasting game” for Wildcard. Players predict whether very specific in-game events will occur, and put down a stake, and based on being right, they build an “Insight Score”

In a similar vein, we saw people bet on Kai Cenat’s and Speed’s Minecraft Marathon, and whether they would complete the game before a certain point

Interestingly, SocialFi Panda and Imran tried to launch Live Bet, a platform where people solely bet on livestreams. However, the platform was sunset this April, due to a lack of PMF

Lastly, I want to pull some arguments from this recent article, “Play As Mechanism: An Intro to Hypergamblified Market Design”:

In here, Lauris argues that PMs are an entertainment loop, with settlement being the payoff. PMs as direct games or rails on top of apps (as invisible infrastructure) will be the “next big long-tail high-variance metagame onchain”

This means he sees an endless variety of small, unpredictable onchain games of speculation, where a few blow up into massive cultural events

PMs are financial markets, but also games in themselves, and open up opportunities for a new category of games to arise

THE YEAR OF GAMIFIED DEFI

A returning topic this year, and so in this newsletter, is “gamified DeFi” (a GameFi rebrand?). So, let’s reflect on what it means, how it developed, and why users have gravitated towards this category of gaming

At the start of 2025, we went through some of Delphi’s predictions covering the subject, through the months we’ve covered various Ponzi games, and we’re slowly seeing the category of trading x gaming grow

In a way, similar to what I talked about regarding PMs just now

Gaming has largely been underperforming this year. However, the subsection of games with ponzinomics and more closely related to money markets has been doing relatively well (e.g., Cambria, OCH, Gigaverse, etc.)

Reasons being that these games provide access to faster capital (with larger upside), have shorter lifecycles, and require less time investment than “regular” crypto games

This makes it difficult for less “opportunity-rich” crypto games to compete for the attention of CT. An audience that largely optimizes for making money

With Ronin’s transition to an ETH L2, and so positioning itself as “Ethereum’s Nintendo”, it is also expanding from “gaming chain” to “gamification chain”, and so focusing on the development of gamified DeFi

So, what does that mean? I believe the term has two buckets:

Degen: apps built for CT that use game mechanics in which token price, markets, predictions, and speculation play a central role

Consumer: bringing consumer experiences onchain, such as Pokémon Pack openings through Courtyard, or Jin’s Fortune Spin on Ronin. Less DeFi, but (secondary) markets are still involved to a degree

The first is a more casino-like experience, the second is more “softcore gambling” for consumers. Naturally, due to familiarity, the apps in the latter category have and will bring the most new users onchain

Ronin looks at gamified Defi from the lens of: “How can gaming-adjacent verticals bring crypto into the everyday lives of our users?”

In this light, comparing Ronin to other L2s, it becomes pretty similar to Abstract, which is positioned as the “consumer chain”

Abstract has the degen apps (OCH, Gacha, Multiplier), etc., and the gamified consumer experiences (Redbull, Modhaus). So, it has me wondering who will be winning the battle for Wall Street’s bet on ETH’s consumer front-end

Overall, gamified DeFi is about wrapping capital distribution in play, compressing market dynamics in experiences that are fast, casual, and viral

ON THE RISE

The Cambria Ronin trials are now live (exclusive rewards for playing on Ronin)