Winning the battle of Wallstreet's bet on consumer ETH

GC ALPHA 62

Disclaimer: None of this information should be taken as financial advice. DYOR + I will hold some of the assets mentioned in this newsletter.

We’re happy to announce our latest initiative: Sidelined.

A live show about crypto gaming, with a dash of DeFi, capital markets, and onchain insights.

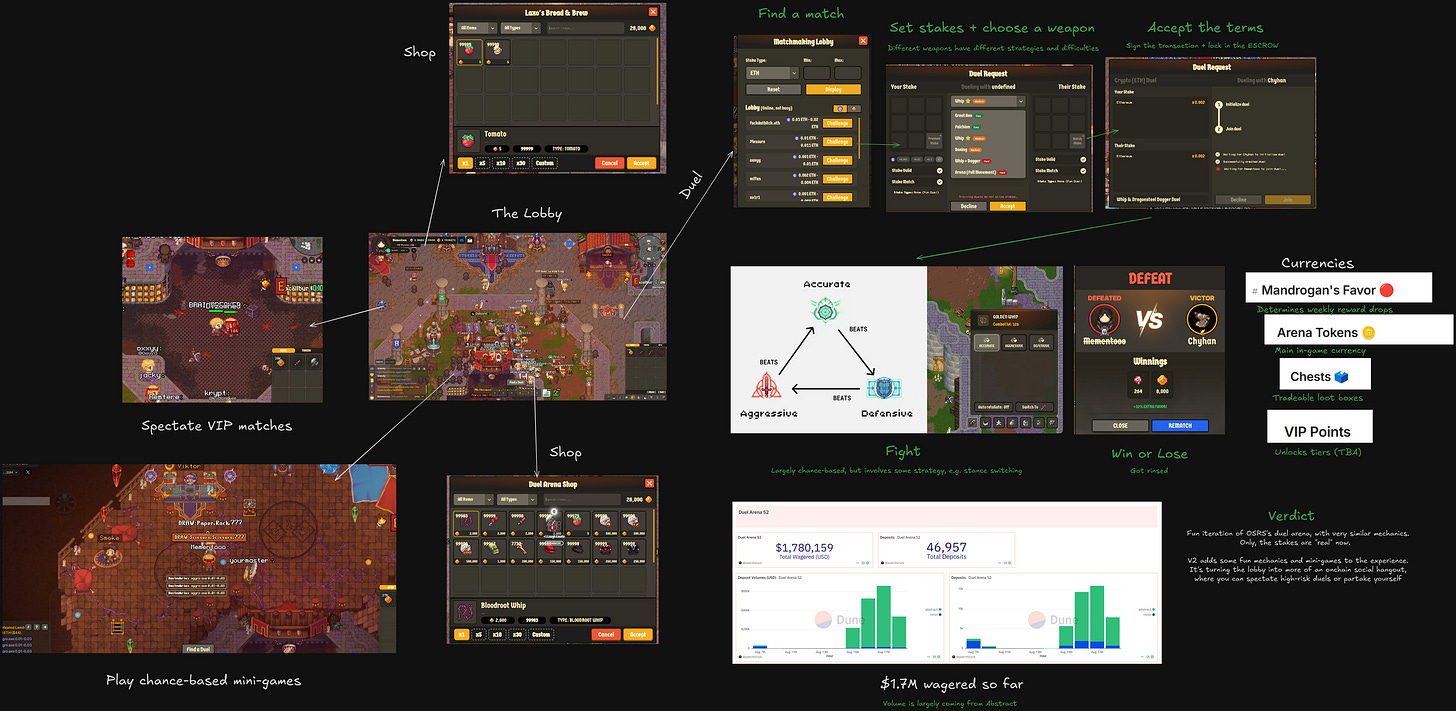

PRODUCT REVIEW: DEGEN ARENA

Cambria’s Duel Arena (V2) is live again. Here’s a high-level overview of the game:

Next week, we will explore…

MARKET TALK

FDF’S PRO LAUNCH

Admittedly, I have talked a lot about Football (dot) Fun (and I will continue to do so lol). Last week, the app finally launched, and it’s been a while since I have seen such excitement behind a crypto-based app

You might have seen one or a couple of “I turned $200 into $600 through FDF” Twitter posts pop up. CT loves everything that makes them money, and it’s a great bonus if it’s wrapped in a fun loop

The seeding of players started with a pack sale, only accessible to players of the previous betas and those with a high enough reputation score

In these (booster) packs, users received a random number of shares from a random player. So, you’d want to pull the best players from different leagues

CT’s love for gacha, combined with a livestream that included various influencers, made for a great way to spotlight the “player reveal”, happening a few days after

Not all players were tradeable instantly, but they are hitting the marketplace in batches of 10, starting on August 13 (until the first 100 are released). These limited releases are a great marketing tool

When the first 10 players got released, it was clear that back buyers were in the green (up to 2-3x per player minimum, I’d say). This was also the first opportunity for the public to be involved

Quickly, it became apparent that sniping players early could be quite lucrative. However, it also incentivized flipping players for a profit, so FDF introduced a “jeet jail” after a couple of days

A couple of days ago, the first FDF Tournament launched. During this event, players receive “TP” (pack currency) and “SP” (skill points), based on the player’s performance

TP is used to buy new packs, and SP is used to promote players from your development squad, or can be cut to earn more TP

However, users have to spend Gold (in-game stable currency) to keep up with players’ contracts, as they expire after 4 games

Lastly, to get an idea of the app’s traction so far:

$1.47M in total marketplace volume (TMV) in the first 2 days, and $2.7M in TMV in less than 7 days. This makes FDF one of the highest-ranking apps on Base, based on volume

RONIN IS “COMING HOME TO ETHEREUM”

In a surprise to many, Ronin announced its “coming home to Ethereum”, meaning they are migrating from their current L1 to an L2 on ETH

The Ronin chain was built 4 years ago, in need of a better and more efficient network to scale. However, tech has now largely been commoditized, and ETH can handle scale (e.g., when using ZK-rollups)

With this move, Ronin is scaling beyond gaming and becoming “Ethereum’s Gamification Engine” or the “Nintendo of Ethereum”. A new way of positioning itself, as it is now growing beyond being “the #1 gaming chain”

The migration also includes a new staking model: “Proof of Distribution”

This model shifts staking rewards from passive validators to active builders. A flywheel that rewards builders based on their “staked-weight” and “builder score”

On the builder score: “These can account for onchain metrics including gas fees generated, treasury revenue, and TVL as well as off-chain metrics like impressions and mindshare”

During the show (50:59 - 52:18), Jihoz explained how Ronin can leverage ETH for security now (instead of validators) and can use these incentives to support builders. Somewhere, he mentioned it to be “the Kaito for builders”

Furthermore, more $RON rewards will be going to the communities

We also asked: “What’s the bull case for RON?” (47:40 - 49:10)

Jihoz explains how ETH is winning the battle for Wall Street’s attention, and how “the gaming chain that wins and does the best this cycle, will be the most appealing to Wall Street”

On this topic, about a month ago, we got some insight from Psycheout that Ronin was going on a VC pitching spree, exploring TradFi opportunities

Lastly, the Substack article says that the Sky Mavis team will be spearheading a new “Emerging Markets Payment strategy”, starting in the Philippines.

“Within Payments, they’ll hone in on Saving, Spending, and later Remittances”

Hereby, it positions itself as an infrastructure for consumer finance. In line with the Ronin’s thesis to economically empower and onboard new users into crypto

Initiatives will start rolling out in Q4 2025

The Ronin migration is scheduled to be completed by Q1-Q2 2026