Why is crypto gaming “dead”? Let's break it down

GC ALPHA 60

Disclaimer: None of this information should be taken as financial advice. DYOR + I will hold some of the assets mentioned in this newsletter.

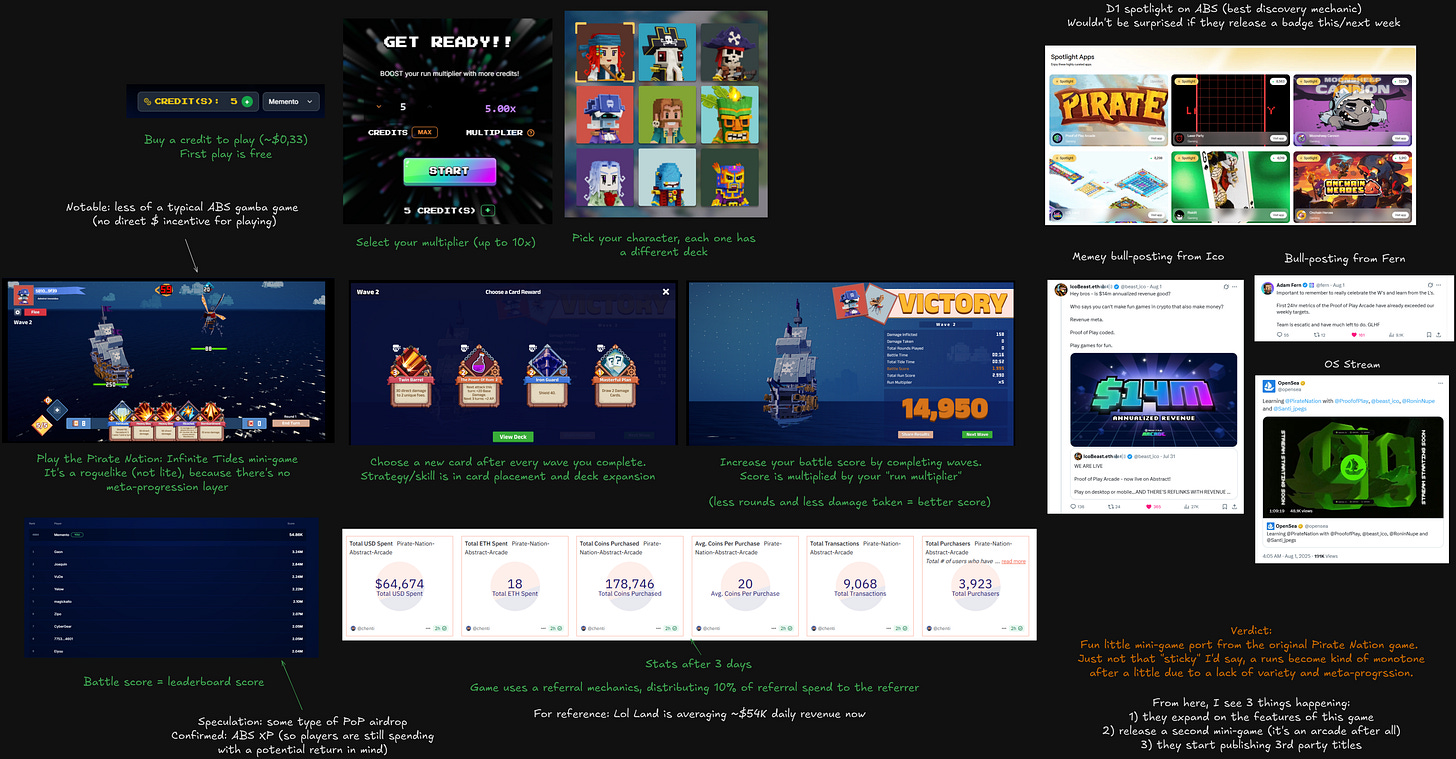

PRODUCT REVIEW: POP ARCADE

Proof of Play has launched the first game in its arcade, Pirate Nation: Rising Tides. Here's an overview of the game and its initial rollout:

Next week, we will explore …..

MARKET TALK

CRYPTO GAMING IS "DEAD" (AGAIN)

A couple of days ago, I published a new article, “Crypto Gaming is "Dead" (Again) - Let's Break it Down”. Almost 5,000 words of me assessing the current crypto gaming landscape. Here’s a (very) high-level summary of what was discussed:

Why is crypto gaming “dead”?

Crypto Twitter sentiment is at rock bottom (if it can’t go lower)

VC funding of crypto gaming has largely dried up

Utility tokens present misaligned incentives between players and VCs

Player incentive structures (e.g., P2E) need innovation

The vast majority of new TGEs have (largely) underperformed this year

Gaming is dependent on ETH, but underperforms comp. to other sectors

Audience vs. product/builder problem

Audience problem: CT consumes games for reasons other than “gamers”

Product/builder problem: crypto games are simply not good enough

There are success cases, but they look different in Web2 and Web3

What needs to change (potential solutions)?

Apptokens and/or stablecoins

Introducing tokens later in a game’s lifecycle

Crypto gaming needs a new vision for retail to rally behind

Conclusion:

2025 has been a year of cleansing: studios shutting down left and right, tokens bleeding out, funding drying up, and sentiment hitting rock bottom. It's “dead.” And yet, this clean slate might just be the reset builders need to start fresh.

The use case for crypto in gaming still holds massive potential, think: digital ownership, player-driven economies, new genres, payment rails, etc.

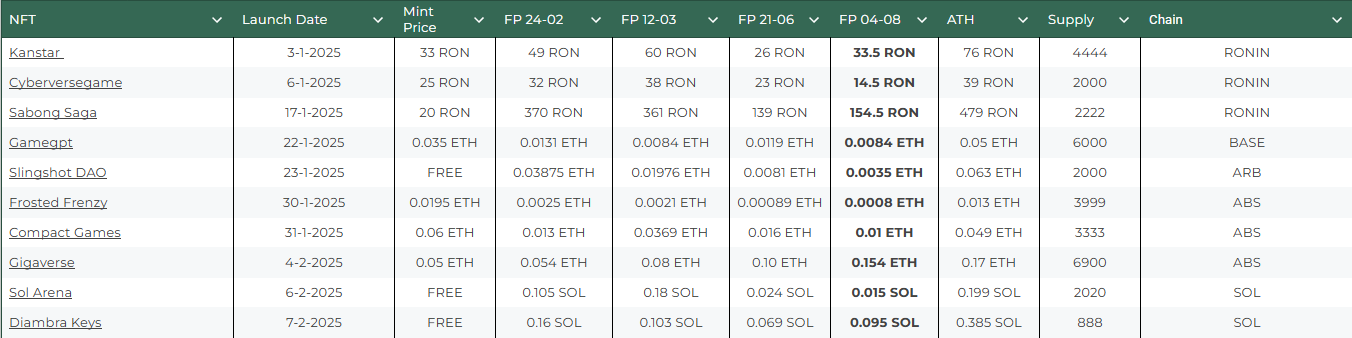

GAMING NFTs UPDATE AUGUST 2025

After 1.5 months (June analysis), it’s time for another 2025 gaming NFT sentiment analysis. Here are my findings (data):

Tracking 87 mints (100+ in total)

Makes for an increase of 16 (tracked) mints over the past ~1.5 months

70/87 (~80%) of mints were paid. This number was 81% in the June analysis

At least 2/3rds of these paid mints are under their mint price

Most mints continue to be on Ronin and Abstract, followed by ETH

However, recently the # of new mints on the blue and the green chain has slowed down

Biggest paid performers: (MP vs. FP) by change in %:

Sabong Saga Genesis: 20 → 154.5 RON (+672.5%)

Gigaverse ROMs: 0.05 → 0.154 ETH (+208%)

Fishing Frenzy Founders Pass: 120 → 470 RON (+291%)

OCH Heroes: 0.069 → 0.188 ETH (+172%)

Monsters.Fun Capsules: 0.125 → 0.454 ETH (+263%)

Moonfrost OG Mystery Box: 150 → $270 (+80%)

Breath of Estova Legacy Egg: 15 → 489 MON (+3160%)

Ragnarok Landverse: Genesis Land: 100 → 228 RON (+128%)

Pixiland: 90 → 179 RON (+98%)

Biggest “free” performers (MP vs. FP):

Anichess Genesis: FREE → 0.3 ETH

Anchiess is the only noteworthy one, because all other free mints are less than $20. Tokyo Games naturally “fell off” post-TGE, and Space Rush’s Genesis collection did as well, post the 2nd collection mint

Sentiment: Neutral (previously: slightly negative)

The gaming NFT landscape looks slightly better than in mid-June, when gauging the more product-backed collections. At the same time, many of the newly launched NFTs, with a lack of product (or updates), continue to trend towards 0

NFT value continues to be driven by product (updates), access to opportunities, and serving as a token voucher (e.g., Anichess Genesis)

Here’s what drives the value of Gigaverse’s ROM NFTs imo

ON THE RISE

Ubisoft’s Might and Magic Fates TCG is releasing a Founders’ Keys collection

Fishing Frenzy will soon introduce AI gameplay using Treasure's Agents