The uphill battle of launching a gaming token:

GC ALPHA 55

Disclaimer: None of this information should be taken as financial advice. DYOR + I will hold some of the assets mentioned in this newsletter.

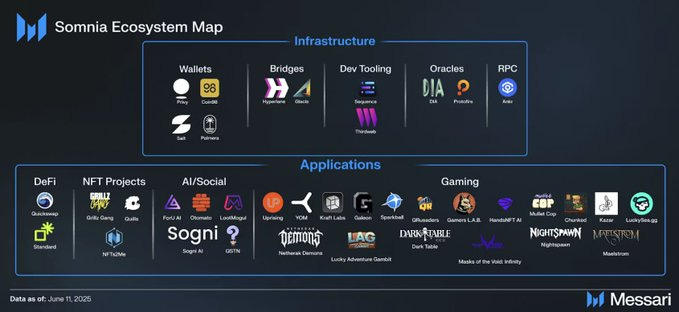

Messari just released a comprehensive report of Somnia, detailing information about its background, funding, builder program, tech stack, roadmap, and more.

An interesting read to get up to speed on the ecosystem.

Sponsored by Somnia.

PRODUCT REVIEW

In this new section of GC Alpha, I want to highlight and discuss new crypto-based consumer apps/(casual) games that I’ve been experimenting with. A short and sweet segment in which I share:

How these apps work (what’s the loop)

How are they gaining the attention (marketing, activations, and incentives)

Why these apps are sticky (or why they’re not)

This new segment will be kicked off next week, starting with a sports-based app.

Feel free to leave any suggestions in the comments.

MARKET TALK

THE UPHILL BATTLE OF LAUNCHING A GAMING TOKEN

Yesterday, I posted a Tweet about the difficulties of launching a gaming token. Lots of interesting takes on this topic, so let’s summarize some of them:

Chris Heatherly (Invite to Mystery) argues that the core problem stems from traders in crypto being impatient and how games need “patient capital”

Furthermore, he mentions how the framing of crypto gaming: investment-first, doesn’t align with how game development works. In contrast, Kickstarter works because it’s framed as a collaborative funding campaign, with “thank you” rewards

Loopify (Endless Clouds) keeps it simple: “pure demand from a good product”

Not only in the form of in-game sinks, but also from the mindshare, speculative value, etc., it can create

Manish (KGeN) points out three things:

Don’t launch your token until you have a healthy D30/D90 retention

Reward only the users who “invest” by buying in-game assets

Don’t see TGE as a route to get rich quick (i.e., it being the end goal)

Cagy (Juice Gaming) mentions a lack of token sinks, no treasury, no buybacks, no revenue, high valuations, a lack of a core community, a lack of rewarding conversion-driven content, and only focusing on Twitter

Derek (Fishing Frenzy) responded that things like revenue and buybacks help with fundamentals, but tokens need mindshare and trust to achieve outsized success

Dad Mode argues that the problem lies in the fundamental lack of value behind most gaming tokens

Additionally, gamers shouldn’t be investors. Most tokens have no use cases or network effects, and TGE design is irrelevant, as emissions don’t fix a broken economy

Tokens should only be added when they enhance a working system…

Matthew Buxton (WARP) mentions that games remain to have 0 token sinks and expect to survive on a few thousand (incentivized) players

Overall, TGEs remain a steep challenge with lots of problems to solve in different areas like distribution, incentives, marketing, but most importantly, fundamentals

Challenging? Yes. Impossible? No

THE STATE OF OFF THE GRID

A couple of days ago, Hunter posted a Tweet about the Off the Grid marketplace. It made me wonder about the current state of the game, so let’s get into some of the market/game metrics (we can find):

The co-founder and CEO of Dappradar made this OTG Market dashboard, tracking all trading data. Over the last 30 days, there were almost 50K in total sales, with 12.3M GUN in volume (~$307K), and 3.8K unique traders

Total volume over time = $376K, notably 43% ($163K) of the total volume was traded just in the past 7 days

Looking at the numbers, the spark in trading seems to be fueled by an increase in net new buyers, fueled by the migration of players to the GUNZ mainnet

Furthermore, the GUNZ <> OpenSea integration has just started rolling out, which might play a role in the increased marketplace activity

Despite trading volume being up, the GUNZ token continues to trend downwards, being down 76% from its TGE. A decrease from a $65M market cap to ~$22M

Naturally, trading volume has tapered down as well. Interestingly, an exchange called Jucoin was responsible for over half of GUNZ’s volume in the past 24 hours

Stache reported that GUNZ node prices have been falling steadily, being 30-60% less than their original sale price. According to him, the reasons are:

People have the wrong idea about the reward rate and value of the rewards. Plus, the delays in the 3rd party marketplace integration

GUNZ Testnet continues to generate a high number of transactions, averaging around 2M or so, with a total of 691M transactions and 17.3M wallet addresses connected

It continues to be difficult to say what percentage of these transactions is meaningful. Furthermore, the claims of 500K daily active players seem deceptive

Active addresses ≠ players, as we’ve seen with Pixels. I would argue, if they reported the “real” DAU numbers, this would break the illusion of the size of the game’s success

We will probably get more accurate numbers of their user base on PC when they launch on Steam soon…

Back in April, the 1kx did report impressive subscriber data, as the game had 100K monthly active subscribers = $14M in annualized revenue

Lastly, by looking at some of the Google Trends data, we can see that Off the Grid scores a 14/100 right now on the 12-month timeline, with its attention peaking in the second week of October

Notably, on the 90-day timeframe, the game is scoring a 100 for today

I would like to add that I am not “hating” on OTG, I am simply sceptical of some of the numbers they are putting out. Happy to be proven wrong though…

thanks