Moonfrost abandons crypto (well...kind of)

GAMING CHRONICLES 144

Gaming Chronicles focuses on curating the latest crypto gaming news every week.

You will find the latest news, educational content, and game reviews.

TLDR :

YGG Play launches $LOL

Animoca Brands on the Nasdaq

Moonfrost leaves crypto

🗞️ NEWS

YGG PLAY LAUNCHES THE LOL TOKEN

This week, the first token on the YGG Launchpad TGE’d, $LOL, from LOL Land

The token launched at a $900K FDV and a 25% circulating supply. Of that supply, 10% was allocated to the launchpad event, 5% is allocated to P2A S1, and another 10% is allocated to liquidity

YGG Play doesn’t have a share in the token, but the LOL Land dev team has a 10% stake (6-month cliff, 18-month linear release)

To participate in the launch of LOL, players had to pledge points and commit $YGG tokens. Players were able to collect points by completing quests and playing LOL Land. Furthermore, players could participate in the P2A season before the launch

LOL is a staking-utility token within LOL Land, and can be staked to upgrade to VIP Status to grant Premium Roll Rewards. They’re also introducing a reward redemption limit, based on your reward redemption ratio (reward/payment). This system is used to control reward extraction

A higher VIP status increases the reward caps and redemption limits

It doesn’t (directly) replace the exchange of in-game coins for $YGG tokens

On the launch itself, currently, the token is trading at a ~$890K market cap and ~$3.6M FDV (3.7x). Unfortunately, the launch wasn’t without hiccups:

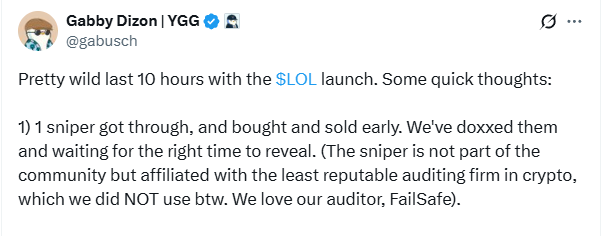

Gabby shared some of his (quick) thoughts on the TGE (see above screenshot):

One sniper got through (by spamming every block), who managed to buy and sell early. I believe it is the wallet with a $160K+ PnL

Trading was primarily happening on Pandora. However, the experience was pretty rough, and people couldn’t trade during the 1st hour

Most people who claimed sold as soon as they could. This will factor into a reputation system and access to future launches

This is unsurprising, not only because of the state of the market, but past behavior we have seen with P2As. This is why supply management is so important

Interestingly, YGG Play will also use the trading fees generated to deepen the liquidity pool (until $1M+), and then use the fees after that to fund player rewards. So, instead of introducing new tokens to the circulation, they “recycle” them instead

Overall, the launch can be considered pretty successful. This seems crucial for the heavily curated approach to YGG Play took, and kind of set the baseline expectations for future launches

ANIMOCA BRANDS PLANS NASDAQ LISTING

Animoca Brands (AB) announced plans to list on Nasdaq next year through a reverse merger with fintech group Currenc Group Inc (CURR). Under this proposal (a non-binding letter of intent), upon completion of the reverse merger, shareholders of AB would own ~95% of the issued shares in the merged entity

For context: “A reverse takeover (RTO), reverse merger, or reverse IPO is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public” ~ Wikipedia

Based on CURR’s market cap pre-announcement, the valuation of AB on the Nasdaq would be ~$2.4B

Currenc Group is a Singapore-based company whose core business is digital remittances (money transfers) and AI-powered fintech solutions. Last year, the company listed on the Nasdaq through a Special Purpose Acquisition Company (SPAC) merger (i.e., acquired a listed shelf company)

Interestingly, AB was previously listed on the Australian Securities Exchange under AB1 in 2015. However, it was delisted due to scrutiny of its involvement in crypto in 2020, and so, it has been an unlisted public company for the past 5 years

As of September 30, 2025, AB’s portfolio included 628 investments across 20+ sectors. At the end of 2024, it ended with $4.3B in total assets.

AB is primarily invested in the gaming sector (27%), followed by infrastructure, Ce/DeFi, services, AI, and other sectors

Specifically, AB’s (gaming) investment strategy always seems to have been very broad, with a couple of huge wins like The Sandbox (which was acquired), Axie Infinity, and OpenSea, which offset the many losses

The founder of Mocaverse (part of AB), Tyler Durden, asked a few questions, including whether the listco will buy MOCA, whether the listco's M&A companies will adopt the token, and whether more tokens would be coming to the MocaPortfolio

The company’s last raise was announced in September 2022, in which it received $110M in a strategic funding round in convertible notes (short-form debt that can be converted into equity)

This isn’t the usual game-like coverage, so I hope I didn’t bore you too much. Anyway, I’d be very curious about the interest of traditional investors in the “diversified digital assets conglomerate”, whether it can catch the institutional bid, and how it evolves as a crypto-TradFi hybrid (i.e., DAT company)

MOONFROST LEAVES CRYPTO (OR DOES IT?)

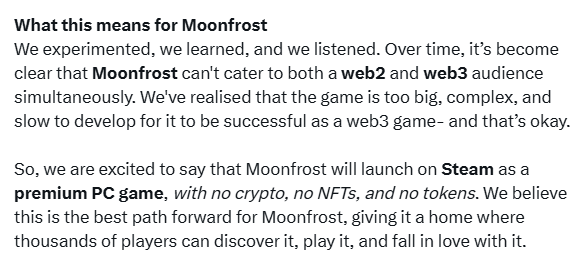

Moonfrost made an “important decision regarding its future” this week, unfortunately, that includes the game leaving the crypto side

The post goes into the whys, which include 1) that it is no longer sustainable for the game to continue on OpenLoot, 2) the game “can’t cater to both a web2 and web3 audience simultaneously”, and 3) the game is too big and so too slow to develop to be a successful crypto game

Point 3 illustrates one of the biggest downsides of building in the open

Moonfrost will continue to live on as a premium PC game on Steam, without any ties to crypto

The problem is that the (Western) PC gaming audience has some of the most vocal and whiny players in existence, who will find out about Moonfrost’s roots, likely leading to review bombing at some point

This clip from the founder, Ric Moore, on the WolvesDAO show (just before the announcement), where he says how the audiences don’t blend at all, hits different now

But, interestingly, this isn’t a complete departure from crypto. As a 2nd post, announced the “Frost Arcade”, mentioned to be a “pure web3 gaming experience”, with multiple browser-based games and an ecosystem of simple games

The existing NFTs/currencies will have utility in this arcade. And it’s the team’s way to cater to both their Web2 and Web3 audiences

Moonfrost just wrapped up 2 events this month, in which items and currency were sold to players. “Fortunately,” these items will still have some use in the future

Jonah commented: “The only reason they do this is to not get sued by shareholders or VCs who have token terms”

Earlier this year, in March, Moonfrost joined OpenLoot (OL). The ecosystem (and chain) that spun out of Big Time. At the time, the community didn’t seem very excited about the announcement, as the two audiences didn’t match

Over the past few years, Moonfrost has pushed a few crypto-facing initiatives:

Launched its free (Genesis) Frost Hunter License collection in July 2024

Launched Early Access Bundles when it migrated to Open Loot, raising $275K

The plans to launch the $FROST token have also been in place for a while. In May 2024, Lizard Labs organized a private sale for the token on their Lizard Launchpad

Funnily enough, Supercell has only invested in one crypto game to date (to my knowledge), which is Moonfrost

The team raised $6.5M through VCs in total through two rounds:

Seed round in 2022: $4.5M (Supercell, Animoca Brands, Griffin Gaming)

Strategic round (?) in 2024: $2M (L1D and Arete Capital)

Overall, it’s sad, but perhaps not too surprising. In this newsletter, we’ve been talking about the “Fork in the road (for web3 gaming)” for months now, explaining how there’s little success to be found in the roads in between. Unfortunately, I think many other PC-first crypto games will see a similar fate

FLASH NEWS

Fishing Frenzy released its whitepaper (FISH, Proof of Contribution, etc.)

Anichess will provide a 7-day refund guarantee on the Kaito Launchpad

🆕ALPHA CORNER

Early Games: Jailed.fun and Cockdotio

Join our Telegram for daily updates & alpha as well: https://t.me/raidenalpha