Launch token, 7 months later its down 95%, then announce you raised $10M?

GAMING CHRONICLES 146

Gaming Chronicles focuses on curating the latest crypto gaming news every week.

You will find the latest news, educational content, and game reviews.

TLDR :

Dappradar is shutting down

Wizzwoods announces a $10M raise

Anichess’s $CHECK token launch

🗞️ NEWS

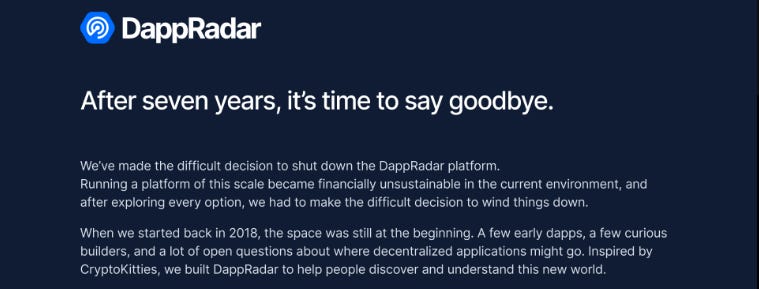

DAPPRADAR IS CLOSING DOWN

DappRadar (DR) has announced that it will be shutting down after seven years of operation: “Running a platform of this scale became financially unsustainable in the current environment…” ~ DappRadar

The platform will be wound down in the upcoming days and will stop tracking blockchains and dapps, plus associated services are being shut down

If you’re not familiar, DR is a blockchain analytics and discovery platform that provides data on onchain activity, including UAWs, TXs, volume, etc. For dApps, DeFi, NFTs, and blockchains, with gaming apps being central to the website

Many (including myself) used the site as a research tool

The company raised a total of $7.33M in total through 2 funding rounds. Its first round was held in 2019, in which they raised $2.33M. The second round was a $5M Series A in 2021

So, it seems that the company couldn’t raise again. However, is an acquisition by CMC still in the books?

On the business itself, DR operated as a freemium tool. Users had to stake RADAR tokens (more on that later) to access to PRO version of the platform to get advanced analytics. Another main revenue generator of the company was selling ad space, sponsorships, and collaborations

Unfortunately, both dwindled over the past few years:

(1) Due to the rise of competing platforms

(2) The marketing landscape changed, making the (fewer) eyeballs visiting DR’s website, worth less (in the eyes of advertisers)In more recent years (November 2023), the platform also introduced quests. Yet, this service couldn’t keep the company afloat either

With the trifecta of revenue decreasing, the high costs of maintaining such an enormous database, and an increasing number of competitors, like Nansen, DefiLama, Dune, etc. DR couldn’t survive

Regarding the RADAR token, there are still decisions to be made that will involve the DAO. RADAR launched in December 2021, peaked at a market cap of ~$25M in February 2023, and is now trading at a market cap of less than $700K

RADAR was primarily used for governance and PRO access (through staking). On the B2B side, it could also be used for premium services and teams boosting (i.e., getting more eyeballs) their products

Furthermore, the token was allocated (40%) to different community incentives

It’s sad to see a company like DR, which has made a lasting impact on the space, close its doors. Yet, I’m slightly optimistic that one of the giants (like CMC, i.e., Binance) might acquire the platform, purely for the mountains of data and data infrastructure this company is sitting on

WIZZWOODS ANNOUNCES A $10M RAISE?

Largely out of the blue, the pixelated Telegram game, Wizzwoods (WW), announced a “casual” $10M Series A raise this week, from Animoca Brands and Infinity Ventures Crypto. Considering the game’s TGE was back in March, and the token is down ~95% since then, the timing seemed odd

An account named “Booga“, whom I believe to be the CEO/founder of the company, said the following: “We kept putting off the announcement because we weren’t ready before”

Frankly, this statement created more confusion. There’s also little information to be found to verify the validity of this round, plus I couldn’t find anything on its Seed round

Regarding the timing, I believe this round must’ve been concluded in Q3-Q4 2024 or before (if it was real in the first place…). The round must have happened before its TGE in March at least, it seems very unlikely they raised this sum post-TGE

One explanation could be that the team is based in China, and they have to operate more diligently due to local laws and restrictions on crypto

I’m pretty sure the team is based there, based on the Twitter profiles of some of the employees, and the fact that the majority of Discord users are from China, based on the #react-country channel

WW has had an interesting history, which started on Berachain in March 2024. In July, they launched their Telegram mini-app, and in September that year, the game surpassed 1M players. Shortly after, it reached 500K DAU in November, and later that month, they shipped a Twitter version of the game

I suspect that they managed to raise based on the (inflated/incentivized) revenue metrics from their game, like many other Telegram-first games did (GC Alpha 02)

As mentioned, the token was released in March 2025. Post-TGE, the project stayed fairly active and kept shipping, and they announced they’re expanding beyond TON, BERA, and TABI in September

WW launched 2 NFT collections:

Chrono-Wizard Bear, a 999-supply collection that was minted for 0.05 ETH. Launched in May 2024

Wizard Morph Cards, an ERC-1115 collection of consumable NFTs. Launched at TGE

Overall, token holders and investors must be down (bad), meaning that any upward price movement will likely be suppressed by the selling pressure of these bag holders. Yet, from the outside, it looks like this team is pretty lean and has the funds to keep shipping, so we’ll have to see if it has any future

ANICHESS’S $CHECK TOKEN LAUNCH

Last week, on the 12th, Anichess launched its $CHECK token. An elaborate token marketing campaign that involved the Tower Ecosystem, OpenSea, AeroDrome, Kaito, Nansen, Birbs, Nansen, and more. Here’s a mini breakdown of the campaign and token launch:

For context, Anichess is a company founded by Anichess and has been co-developed in partnership with Chess.com. We talked more about it in GC News 138. The CHECK token launch was done under the Checkmate Ecosystem, which is a larger ecosystem with infrastructure to create AI-generated games

Firstly, let’s talk about the tokenomics. CHECK has a 1B supply, with 59% allocated to the community and ecosystem growth. 39.38% is going to the player rewards pool, with 5% (the airdrop) unlocked, and 36 months of vesting

Of this 39.38%, 10% (so around 1/4th) is allocated to the Eternals NFT collection, which, of a small %, was unlocked at TGE, and the rest will be unlocked monthly. Another 10% is allocated to a player airdrop, which will be unlocked over the next 3 months

CHECK launched with a 16.5% initial circulating supply. 7% (~45% of the ics) of the supply is in the hands of the community, and the other 9.5% is in the ecosystem and treasury, operation expenses, and liquidity pool buckets

The CHECK token launched on Aerodrome, a platform that integrated with Coinbase’s DEX integration not too long ago. From a high level, it works as follows:

Projects seed initial liquidity → deposit incentives attract votes → veARO voters direct emissions → community provides liquidity → trading starts

4% (of the total supply) went to Aerodrome Voters as a deposit and LP incentives

CHECK later also got listed on CEXes, including MEXC, XT, and Kraken. The Kraken listing announcement and trading going live bumped up the token by 183% DoD

Other than that, tokens got distributed through a CHECK sale on Kaito. 2% of the total supply was allocated to the sale at a $35M FDV, 100% unlocked at TGE. At the moment, the token is trading at a ~$27M FDV. Fortunately, Anichess gave a 7-day refund guarantee for all participants

Assumingly, the vast majority (if not all) was refunded, which is probably better for all parties involved

In terms of broader GTM, Anichess allocated 2.5% to Nansen Points holders and airdropped tokens to Moonbirds x Anichess SBT holders

The purpose of these initiatives is to gain the attention (and so liquidity) of users beyond their own communities, but the result is often more (unaligned) holders dumping tokens on your head

Lastly, Anichess partnered with OpenSea for its launch. This included an interview feature in the form of an article on their website, plus Mongraal playing Anichess on Stream, on Chess.com

Overall, this launch was pretty extensive from a marketing perspective, but it lacked a good narrative and strong economics imo (plus the market isn’t great). Despite it going sub $1M MC just today, the price largely recovered through the Kraken listing (I wrote it in the morning, and edited this piece in the evening)

Usually, the price increase from new listings (quickly) retraces, though. So we have to see if CHECk can push further to at least get back to its Kaito round price of a $35M FDV

FLASH NEWS

🆕ALPHA CORNER

Early Games: None for this week.

Join our Telegram for daily updates & alpha as well: https://t.me/raidenalpha

The Wizzwoods timing really raises questons about how crypto gaming projects handl investor relations. Announcing a $10M raise after your token crashes 95% feels like sending mixed signals to the comunity. On one hand, securing funding means belevers in the long term vision, but on the other hand it makes you wonder if VCs got better terms than retail holders who bought at peak. The gap between player traction (500K DAU is solid) and token performace shows how disconnected game success can be from tokenomics.