Here's why onchain Runescape will pop off this season:

GC ALPHA 43

Disclaimer: None of this information should be taken as financial advice. DYOR + I will hold some of the assets that are spoken of in this newsletter.

(P2A) EVENTS & SOCIALFI

Pirate Nation's PvP feature launched with 10M PIRATE in prizes

Defi Dungeons went live (you need an NFT to play)

Cambria Season 2: The Paymasters will launch today/tomorrow (slightly delayed)

MARKET TALK

WHY THIS WILL BE CAMBRIA’S LARGEST SEASON

The risk-to-earn MMO/the onchain Runescape for degens is returning today with Season 2. I speculate this will be Cambria’s largest season yet. Here’s why:

Paymasters: S2 brings a new in-game class, “the Paymaster”. As a player in this role, you buy Royal Charters and convert them into Syndicate Shares. Shareholders earn based on the taxation of the player economy (in short)

Paymasters are idle investors, whilst Viceroys (Guild Owners) are active investors (docs). This new update creates an interesting participation layer to the metagame for players who are crypto-rich but time-poor

It’d be interesting to see the change in financial interest compared with the previous season

Thesis: More liquidity demands more attention, demanding more liquidity 🔄

Abstract Streaming: Cambria partnered with Abstract a couple of months ago, primarily for its native streaming features. At launch, the game will be one of the top (crypto-native) games on Abstract

I anticipate that the Cambria content on CT during Season 2 will be five times more than what we saw in S1 (flywheel: streaming incentives > more streaming > rich clips > distribution > mindshare)

Season 1 payouts: At the end of Season 1, many players shared a picture of their earnings, which seemed impressive across the board, especially when compared with the average P2A payout nowadays

Cambria’s player base has been quite condensed from the start, with high spenders (dolphins and whales); however, because of the potential earnings, I expect this season to include much more of the farmer archetype

Excited to see how this 14-day season unfolds and its impact on liquidity, attention, and the player base

Note: I am invested in Cambria Cores

UPDATE: GAMING TGEs 2025

In the past week, we had a couple of notable token launches, so it’s time for another (depressing) “gaming TGEs 2025 update”:

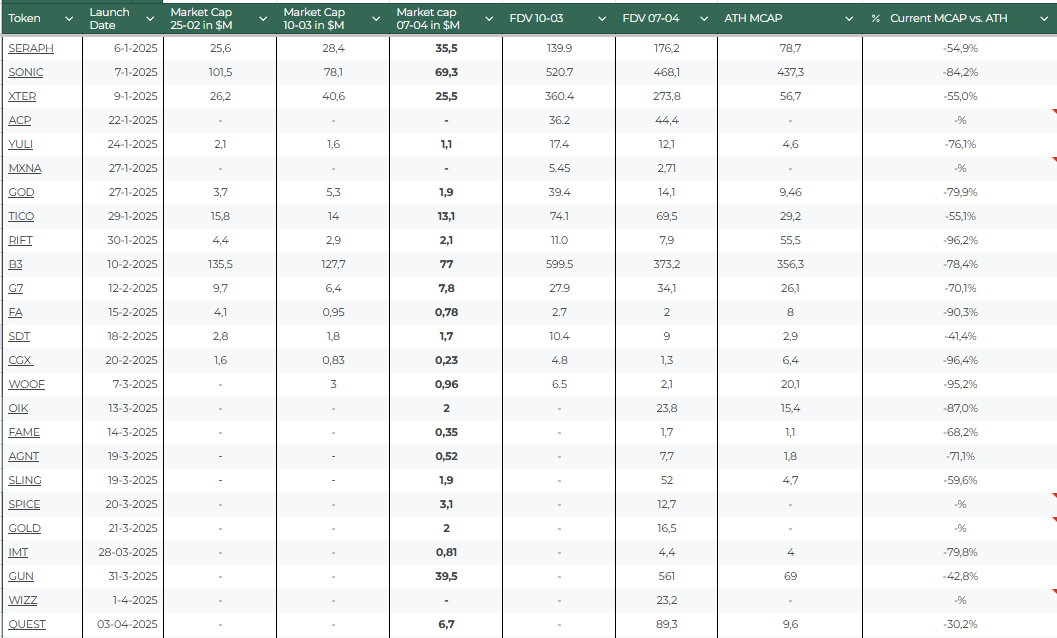

Tracking 24 tokens right now; however, the total number of token launches in 2025 should be in the mid-30s

The macro environment has been tough in the past month, reflected in the general drop in prices across almost all gaming tokens from 10-03 to 07-04

GUN took over as the current token with the highest FDV, SONIC and B3 are second and third. But both tokens have a significantly higher market cap

Trend: The low circulating supply, high FDV approach has become more popular recently, so projects have more control over their charts. It’s a defense mechanism in a market with fewer buyers than sellers

GUN was an important launch for crypto gaming as a category regarding Binance listings, funding, and general sentiment. The first week of the launch was disappointing (also because of macro), however, the past 2-3 days have shown stronger volume again

Usually, tokens see the pinnacle of attention at their launch, and therefore, the launch period can be overly judged. Hopefully, the next two - three weeks will paint a brighter picture

The tokens tracked are down ~70% on average from their ATH mcaps. We continue to see a peak at launch and then a slow/fast burn downwards

Does the problem stem from a lack of innovation, broken distribution, poor market sentiment, or a mix of all the above?

Expecting teams like Uncharted (Fishing Frenzy), Gigaverse, and MapleStory Universe to push the boundaries of what a token launch looks like

Overall, Q1 has largely been a disappointment, outside of the little hope we had in the first week or so in January. Nevertheless, we have hope as crypto gaming has never been this promising from a product perspective