Gigaverse turns on the “double burn flywheel”

GC ALPHA 71

Disclaimer: None of this information should be taken as financial advice. DYOR + I will hold some of the assets mentioned in this newsletter.

MARKET TALK

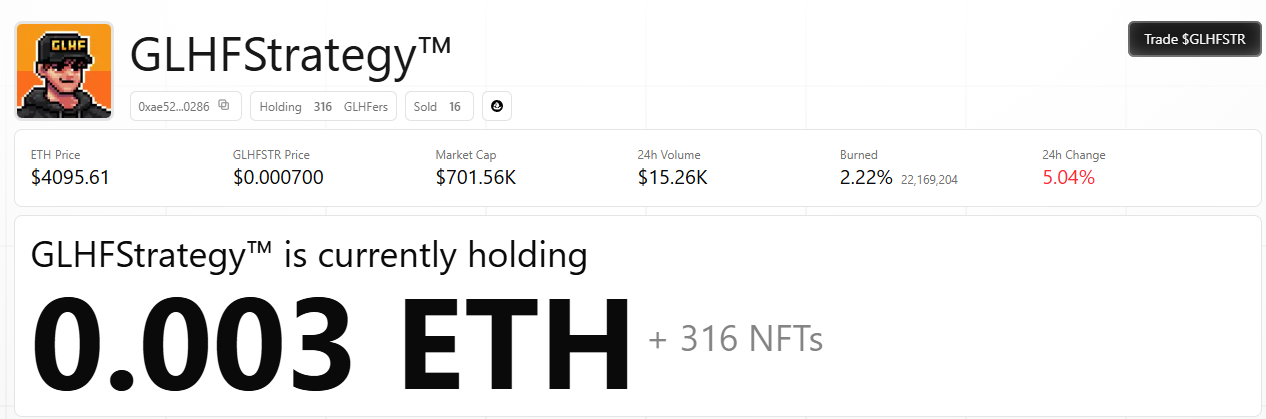

GLHF’ERS TURNS ON THE FLYWHEEL

Last week, GLHFers introduced its TokenWorks strategy alongside a new $GLHFSTR token. A new spin on the PUNKStrategy that leverages a “double burn flywheel”, here’s how it works (Aiz also made an easily digestible graphic):

“The Auctioneer” (the OG mechanics):

The first part of the design utilizes the Auctioneer, a modified version of the Nouns (the collection) contract, personified through a character stylized after the Monopoly Man

It was introduced in January of last year and tasked with performing auctions of 150 1/1 special characters

For context, during the original GLHFers mint in 2024. 150 was the number of NFTs that remained unminted, and so it was turned into a special collection, with a batched, auction-based release schedule

The 1/1 characters play a special, long-term role in the GLHF ecosystem, with each batch serving a distinct and unique purpose

After every auction, the funds are used to buy back existing NFTs from the GLHFer collection and burn them (randomly) to reduce the supply

The NFTStrategy (new mechanics):

A new 1/1 auction called “The Strategists” (a collection of 10 NFTs) was introduced. Upon winning an Auction, the new holder would receive 5 - 10% (randomly determined) of the fees attributed to GLHF from the first 10 days of $GLHFSTR trading

The Auctioneer essentially buys the NFTs from the Strategy. Then, Strategy uses the proceeds to buy and burn GLHFSTR tokens

Trading fees from the GLHFSTR token are then used to:

Buy GLHFers NFTs → sell them → buy back and burn GLHFSTR (8%)

Buy back and burn PUNKSTR (1%)

Fund the Treasury (1%) - the auction incentive

The Auctioneer bought up ~15% of the collection already (since last year), with over 120 ETH raised from the last 10 auctions, and over 100 auctions (out of the 150) to go

Currently, the GLHFSTR token is trading at a ~$670K market cap, down about 50% of its ATH. Volume of the token is a bit flat right now, with only $17.8K in the past 24 hours (and volume creates the incentive for the collection)

However, only 3/10 characters of the Strategists collection have been auctioned so far. This means another 7 characters will be sold, creating buying pressure (and volume) for the GLHFSTR token, and generating fees for the incentive pool

Overall, it’s an interesting experiment from GLHFer to incorporate DeFi mechanics into the gaming side. Frankly, experiments like these are needed to pull more liquidity and interest to this sector

NFT ANALYSIS UPDATE (OCTOBER)

It’s time for another NFT update, since my last one was already almost 2 months ago (August update). With only ~2 months remaining for this year, we’re getting close to a full year of tracking gaming NFTs. I will post some reflections on 2025 at the EOY

Here are my findings of the October update:

Tracking 113 mints, with an estimated 130+ mints in total

That’s an increase of 26 (tracked) mints over the past ~2 months

86/113 (~76%) of mints were paid

At least 80% of these are below their mint price. Just like tokens, many NFT collections are launched before teams find PMF or even a product

From a high-level view, it also seems a good number of these projects simply get abandoned, or no value returns to the collection

Most mints continue to be on Ronin and Abstract, followed by ETH

Largely fueled by the vast number of immigrations and new projects on these two chains. However, looking at more recent examples, the mix of mints is more diverse, including ETH, IMX, SOMI, etc.

Trends:

Collections on Ronin are the most stable in price (denominated in RON), yet they’re losing value due to $RON depreciating

Lots of paid mints

The reason being twofold, I believe: 1) free mints lack upside as they attract a different class of holders (often jeeters), and 2) for teams to raise funds

Over 90% of mints are trending down, which isn’t too much of a surprise, as there’s only a handful of interesting projects

Pretty even distribution of low (0 - 2000) and mid collections (2000 - 7000)

High price, low supply (<1000) is one of the more profitable collection ranges in $ terms. Think SUP Foundation (right post mint), Oh Baby Games, Tokyo Games (right post mint), and Monsters.Fun (right post mint)

A caveat is that not many projects can pull off these types of sales models and can’t sustain these high prices either (like some of the examples above)

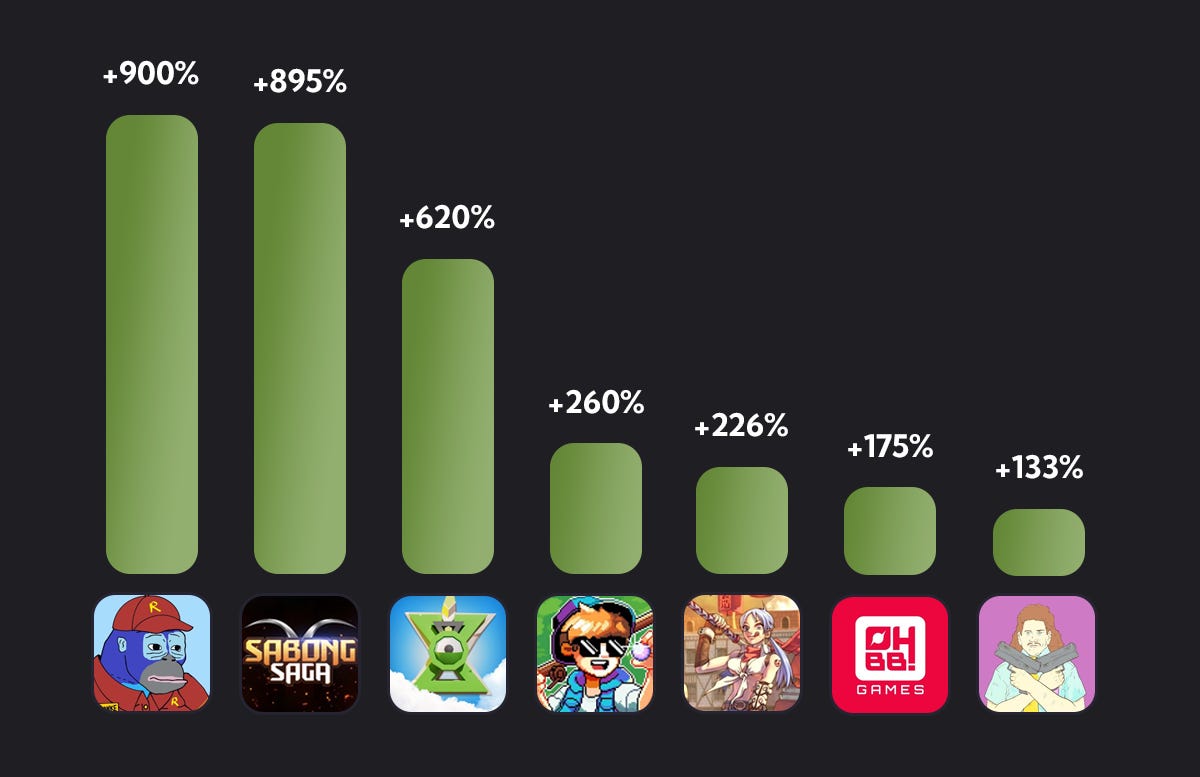

Biggest paid performers: (mint price vs. floor price) by change in %

1) Ronke: 15 → 150 RON (+900%)

2) Sabong Saga: 20 → 199 RON (+895%)

3) Zeeverse Oath: 10 → 72 RON (+620%)

4) Fishing Frenzy: 120 → 432 RON (+260%)

5) Rag Landv: 100 → 326 RON (+226%)

6) OBB: 0.1 → 0.275 ETH (+175%)

7) Mullet Cop: 45 → 105 SOMI (+133%)

8) Pixiland: 90 → 189 RON (+110%)

9) Gigaverse ROMs: 0.05 → 0.1 ETH (+100%)

In absolute terms (in $), OBB and ROM minters profited the most

Overall, adjusting my sentiment back to “Slightly Negative”, even though top NFTs are sustaining their value pretty well, there’s a lot of slop, and a lack of appetite for gaming NFTs

ON THE RISE

Valannia is launching in November on Indie.fun (you can apply for WL now)