Gaming studio blames everyone, but themselves, for their failure...

GAMING CHRONICLES 148

Gaming Chronicles focuses on curating the latest crypto gaming news every week.

You will find the latest news, educational content, and game reviews.

TLDR :

Aether Games shuts down

SDF whitepaper release and ICO

BGA: 2025 state of the industry report

🗞️ NEWS

AETHER GAMES SHUTS DOWN

After barely processing ChronoForge’s shutdown announcement, Aether Games (AG) followed by sharing that it is officially shutting down earlier this week. To bring the bad news, the team wrote a long message in which they blamed a myriad of different factors for their failure…

Honestly, the thing reads more like a complaint letter than a “shutdown notice”. Here are some examples:

“Too many KOL, partner, and advisory deals were made in bad faith, and they cost us heavily.” and “We cannot stress this enough. They (KOLs) drain liquidity, then disappear the moment you launch”

“We worked with agency after agency, most promised the world, and when results did not come, it always became “market conditions.”

“The ongoing costs of operating in this space, audits, compliance, security, listings, tooling, and endless “required” extras, continually drained funding while delivering less and less impact.”

And that’s not even all of it…We all know crypto gaming is a hard space to succeed in, but as a builder, that’s a risk you need to be willing to take. Simply said, the team couldn’t find success because their games couldn’t attract enough players, which is something the team itself is primarily responsible for

AG was founded in 2021, starting as a “transmedia studio for games”. In Q4 2022, it released its first game, called Cards of Ethernity (CoE), a TCG. The next year, in 2022, the studio raised $4.5M in a seed round led by Polygon and Mysten Labs

In February 2024, the team announced CoE: The Wheel of Time (a crossover of the game with the fantasy novel IP). A month later, they launched the AEG token (more on this later). And in 2025, they retired the original CoE in July

During this journey, the studio tried to pivot and expand beyond its TCG:

“At one point our pivot was to support crypto games by helping them publish, start smaller, and build from there”. However, they concluded that there wasn’t sustainable success in the crypto gaming market

In June 2025, it also shared a prototype for a dungeon crawler game

As mentioned, the AEG token launched in March 2024. In the first month of trading, the token performed well, reaching a $18M mc and closing in March at aroun $10M. However, from April on, the token started trending down quite rapidly. Their MM couldn’t save them either:

“Our market maker kept buying dips to support liquidity until they were fully drained, and at that point we were left without the funding we desperately needed”

Recently, the team received notices of delisting the token from KuCoin and Gate, and earlier this year, it was already delisted from Bybit. Today, AEG is trading at a ~$80K market cap, down over 99% from its opening price

The lack of taking responsibility for their failure is what sticks out the most here. On this topic, there’s a lot that can be learned from how SUPERVIVE approached communicating their closure

SPORTS.FUN ICO AND WP LAUNCH

In the past few weeks, Sports.Fun (SDF) received an investment from the Coinbase Ventures Fund, released its whitepaper, and held an ICO on Legion (Kraken’s ICO platform). Let’s talk about it…

Firstly, let’s briefly address the investment from Base. Recently, I have seen more teams announce (like LiveFrame) that they received funding from the ecosystem. It looks like they (Base) wanted to time this with the full release of the Base app

Secondly, they released the SDF whitepaper. I won’t go into every detail, but will share some of the highlights:

“$FUN is not an inflationary gameplay token and is not required to participate in the core fantasy experience.”

It’s an ecosystem token that sits above the core game loop of the “.Fun experiences”. Its primary utility is value capture via buybacks, trading fee rebates, and early access features

Outside of the ecosystem token, there are 100s of player tokens. These utility tokens are nominated in Gold (USDC)

The FUN token has a supply of 1B: community (25%), team (25%), investors (24.8%), treasury (17.7%), and public sale/ICO (7.5%)

Close to 50% of the tokens are allocated to the team and investors. This is pretty hefty (~35% is average). Furthermore, the team only has a 6-month cliff, although 42 months of vesting, and investors have no cliff, with 36 months of vesting (both non-linear)

Thirdly, the ICO on Legion. Earlier this week, the details on the public sale were released:

Raising $3M at a $60M FDV. Half of the tokens are unlocked at TGE, and the other 50% has a 6-month linear release schedule

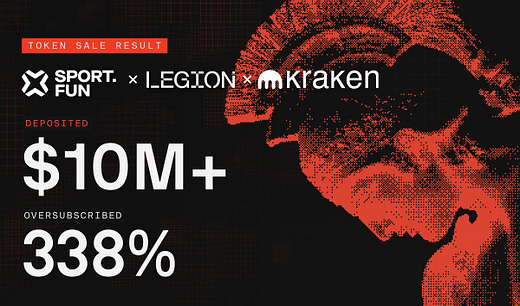

The sale went well, with $3M raised in a little over 24 hours, $4.5M raised in 30 hours, and a total of $10M+ deposited during the 3-day sale (338% oversubscribed) from 4.6K unique buyers

A great accomplishment in a period where we’re being flooded with ICOs. Frankly, SDF is just one of the few (if not only) that have the revenue numbers to support their claim to success

“That $3m gives us the funding we need to modestly expand the team, bump up our mainstream GTM strategy (which is built around high ROI guerilla social media marketing campaigns btw) and set ourselves up strongly for building for years ahead.” ~ Adam, Founder of SDF

TGE is expected to be somewhere in January 2026

Lastly, I know that Delphi Digital has done some work with SDF, and so JACL posted two articles on the thesis: “Achieving Meaningful Differentiation” and “The Opportunity at Hand”

In here, JACL shares some interesting data on the sports-betting market, the value proposition of SDF, and his outlook: “All that now remains is for the team to further refine the UX and player journey, complete phases 2 and 3 of the 2026 roadmap, and scale the user base beyond Web3.”

Congrats to the FDF team, and I’m looking forward to their expansion strategy (disclaimer: I still hold some player tokens)

BGA: 2025 STATE OF THE INDUSTRY REPORT

Last week, the Blockchain Game Alliance (BGA) published its 2025 state of the industry report. A report based on interviews with the various leaders of our little industry. After going through it, I wanted to share some of the highlights and things I found interesting:

For the report, 506 valid responses were recorded (smaller than 2024: 623). The majority of these respondents worked in a gaming studio or gaming publisher (32.6%), some of the other, larger categories included service providers (18.0%), protocols (11.1%), guilds and esports (7.9%), and marketplaces and launchpads (7.5%)

Respondents were asked about their outlook on the industry (1) and their company (2) over the next 12 months. I find the results pretty surprising in how positive they are, but if we were to poll CT the same way, I’d imagine they’d look less “rose colored”

Very optimistic: (1) 21.7% (2) 26.3%

Somewhat optimistic: (1) 44.1% (2) 40.3%

Neutral: (1) 19.8% (2) 17.8%

Somewhat pessimistic: (1) 10.3% (2) 6.3%

Very pessimistic: (1) 4.2% (2) 4.0%

Prefer not to say: (1) 0% (2) 5.3%

The report states 3 major industry drivers and 3 industry challenges:

Macro drivers include: policy and regulation, high-quality game launches, and sustainable revenue-driven business models

It’s interesting to see how these drivers have evolved from 2021-2025. In the previous years, we saw game/UX improvement, franchise adoption, and studio adoption as the largest drivers

“After several cycles of over-promising and under-delivering, respondents now anchor future growth in the elements that have historically driven durable success in gaming”

Macro challenges include: scams and fraud, lack of funding/investment, and AI-enabled cheating, bots, and exploits as the largest risk of AI adoption

Furthermore, the 3 greatest threats to the industry were mentioned: scams (36%), poor-quality games (20.4%), and Ponzi-style economics (12.7%)

Individual challenges included: lack of funding (32.6%), UA (27.1%), and user retention (24.9%)

A couple of the larger topics of the year include:

Stablecoins: key insights here are on the topics of UX, regulatory clarity, developer monetization, interoperability, and sustainability

We discussed BGA’s stablecoins and gaming report in GC News 142

One (larger) downside of stablecoin adoption is how it’s still way too risky for (traditional) gaming studios to keep an onchain Treasury

AI: key insights here are on the topics of implementation, efficiency gains, ethical and legal ambiguity, transparency, and risks

The 3 biggest concerns about AI are cheating, bots, and exploits (38.9%), an over-reliance on AI (36.8%), and a loss of human creativity (32.8%)

Industry shakeout: key insights here are on the topics of funding drought, real revenue, game quality, UX, and reputation

“…multiple studies suggest that 80–93 percent of Web3 games fail, with average lifespans measuring only months — a rate comparable to the high mortality observed in mobile and indie gaming more generally”

UA crisis: key insights here are on the topics of token-led UA, fragmented chains, rebuilding trust, KOL marketing, and multi-platform

“Avoiding the Web3 label may reduce stigma, but it also removes the narrative distinction needed to stand out.” ~ Nicolas Pouard from Ubisoft

Overall, as the report states, 2025 has been a challenging year in which we have returned to our fundamentals. The industry is shedding its nonsense, we’re maturing, and the expectations are becoming more realistic

Will 2026 be a better year for crypto gaming? Let’s hope so

FLASH NEWS

Mythical Games is planning to launch a USDC-based player market

During Cambria S3, almost $1.7M was spent by over 40K players

Mocaverse launched the beta for MocaProof: a new reputation system

Pixels is working on a new product called Stacked: “The Appsflyer of P2E”

🆕ALPHA CORNER

Early Games: None for this week.

Join our Telegram for daily updates & alpha as well: https://t.me/raidenalpha